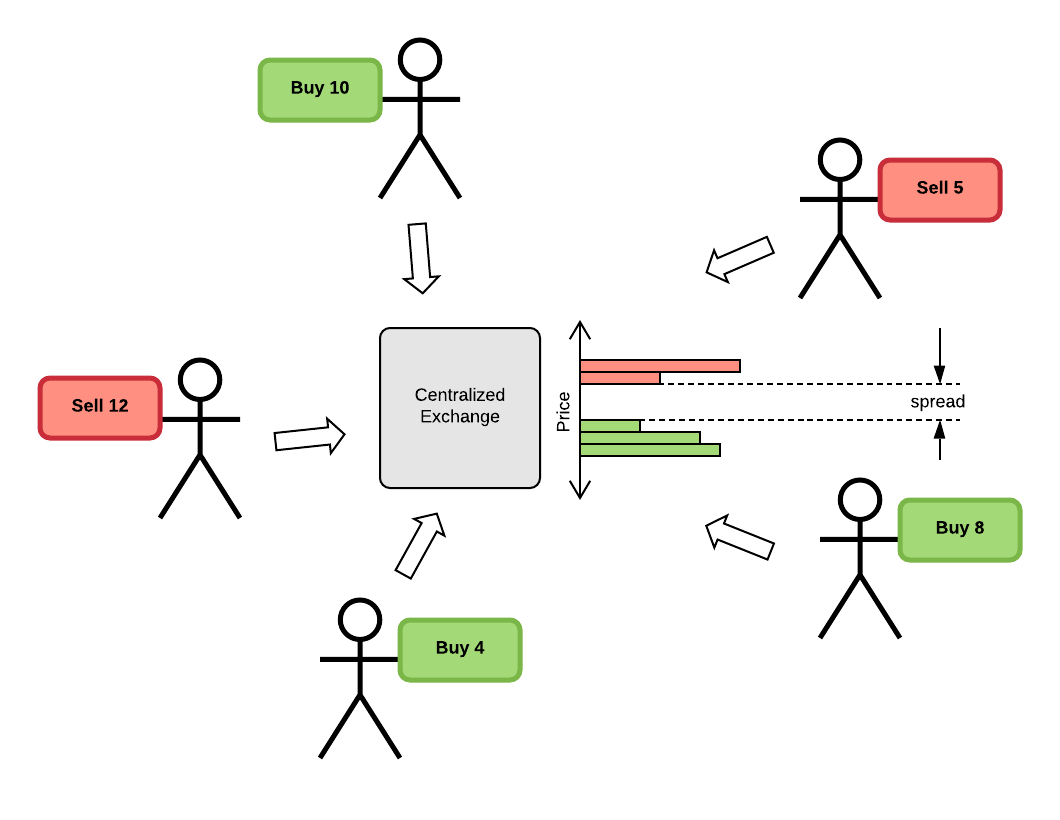

The questions of counter party discovery and price agreement are traditionally answered through the use of a centralized exchange, where orders can be routed and collected into a bid / ask order book, with the sell orders at a generally higher price and the buy orders at a generally lower price, separated in most cases by a price gap known as the “spread”.

The potential buyers and sellers from the previous page with assets to buy and sell can now route their orders through the centralized exchange as shown in the figure below.

As buyers and sellers with less price sensitivity place market orders (meaning, fill this order at the best available price), the price tends to “ping pong” across the spread gap between the best buy price and the best sell price.

There are several problems with this method of centralized price discovery:

Problem #1. Because the order flow is centralized and information takes time to propagate, the prices generated are valid only at the instant the trade is matched, at the location where the matching occurs. Any price dissemination over a widespread geographical area will have latencies built into the prices that will vary based on distance as well as network quality.

Problem #2. Because the price discovery mechanism relies on order flow and trade matching, low liquidity assets or assets not yet trading (as an example, pre-IPO stocks) will not usually have an accurate agreement on price, since the price discovery depends on a trade and therefore these types of assets will generally have a larger spread (or no spread at all).

Problem #3. Because the price discovery mechanism is tightly coupled to trade execution, the resulting system is unstable over short time durations - buying results in generally higher prices which can trigger more buying, and selling results in generally lower prices which can trigger more selling. The larger quotes lie on the outside of the spread so it is easier to influence the short-term price.

Decentralized exchanges (DEXs) built on blockchain technology are usually an adaptation of the centralized trading paradigm, with order book and trade matching logic ported into smart contracts or Dapp logic that runs in a distributed fashion across the network. These solutions do not overcome the two problems of information latency or low liquidity assets, but they do offer a way to execute trades in a manner that does not rely on a single trusted entity. They also still have the issues associated with price discovery being tightly coupled to trade execution.