Microtick will provide its real-time price data at no cost to the blockchain ecosystem over the Cosmos IBC protocol, which enables other Dapps on other chains to use this data. But what good is a price oracle if there's no way to hedge your risk if you depend on that price?

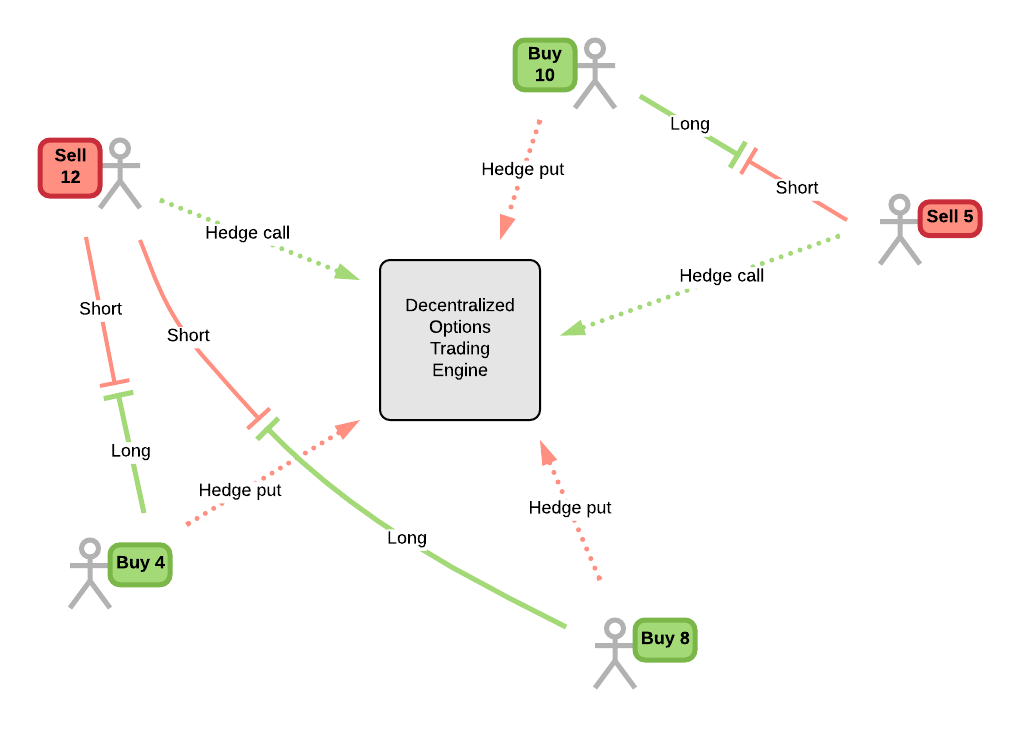

Fortunately, Microtick provides this ability. Developers (and users of Dapps) using Microtick as their price oracle can hedge risk by taking a low-cost at-the-money option, with a strike price at the current global consensus price, using a time duration appropriate for their particular risk exposure.

On the opposite side of a hedged position is a market maker insuring their price quote with token backing. The market maker's goal is to earn option premium, priced at (or slightly above) fair value and earn money over time by maintaining the price quote as the real-world price changes.

It is also possible to speculate on price movement (for example, with an upcoming news event or hard fork) by purchasing a Microtick call or put with the appropriate time duration.